Companies

Self-employed & liberal professions

Breadcrumb

- Home

- Insights

- Benefits new addition cafeteria plan 13th month

Insights

The benefits of the new addition to the cafeteria plan via the 13th month

The traditional cafeteria plan has recently been enhanced with a unique new feature: coverage for outpatient costs, in addition to hospitalization insurance. This new coverage is financed through the 13th month salary.

What makes this insurance unique?

- Available from 1 employee: Even small companies can benefit from this coverage.

- Optional participation: Employees can choose whether to participate.

- Family inclusion: Family members can also be covered.

- No waiting periods: Immediate access to benefits without waiting times.

- No medical formalities: No need for medical examinations or questionnaires.

Coverage Includes:

- Dental care

- Optical care

- Other outpatient costs: such as medical services, physiotherapy, analyses, imaging, prostheses, and medications.

Why outpatient coverage?

Research shows that 82% of employees currently have hospitalization insurance, while only 5% have outpatient coverage. Many expenses that are still privately borne are outpatient costs, averaging €570 per year per Belgian. This coverage offers an ideal solution in the "war for talent" by providing an extra benefit that can make a significant difference for employees and their families.

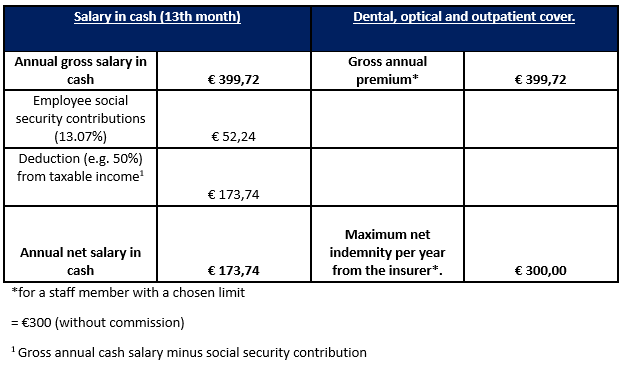

Benefits in numbers

In the example provided, a reimbursement ceiling of €300 per family per year is used, but other ceilings up to a maximum of €1,800 are also possible. This allows employers to offer something unique and cost-free, which can make a world of difference for their employees.

For more information, you can contact Van Dessel at 03 482 15 30 or via email at leven@vandessel.be.