Customers purchasing financial products and services in Belgium are protected by MiFID, or the Markets in Financial Instruments Directive. This European Directive lays down a code of conduct and organisational requirements that must be respected when providing investment services, with the objective of offering maximum protection to investors. Since 30 April 2014, some elements of the code of conduct and certain organisational requirements also apply to insurers (insurance companies and intermediaries). Below you will find an overview of the main elements of the AssurMiFID code of conduct* and organisational requirements that protect you when you purchase our insurance products.

Products and services offered

Insurance broking

We provide insurance broking services, which cover the provision of advice on insurance policies, making offers and proposals, carrying out preparatory work prior to the conclusion of insurance policies and the conclusion of insurance policies themselves, as well as assistance in managing and implementing those policies.

Numbers and nomenclature of insurance branches

1. Accidents

2. Illness

3. Fully comprehensive vehicle insurance with the exception of rolling stock

4. Fully comprehensive insurance for rolling stock

5. Fully comprehensive insurance for aircraft

6. Fully comprehensive insurance for seagoing and inland vessels

7. Transported goods including merchandise, luggage and all other goods

8. Fire and natural disasters

9. Other damage to goods

10. Civil liability insurance for motorised vehicles

11. Civil liability insurance for aircraft

12. Civil liability insurance for seagoing and inland vessels

13. General civil liability insurance

14. Credit

15. Security

16. Various monetary losses

17. Legal aid

18. Emergency assistance

21. Life insurance not in connection with investment funds, with the exception of dowry insurance and birth insurance

22. Dowry and birth insurance, not in connection with investment funds

23. Life, dowry and birth insurance in connection with investment funds

26. Capitalisation activities

27. Management of group pension funds

Policy terms and conditions

As an insurance broker, we work together with various insurance companies. Each company has their own general and special policy terms and conditions. To find out about the specific terms and conditions for each company and insurance product, please refer to our page Policy terms and conditions.

Duty of care

In order to assess whether you meet the conditions for the proposed insurance products and whether they are suited to your needs, we as an insurance broker have a duty of care. This means that we analyse your needs and requests in order to propose to you the most suitable product.

Conflict of interest policy

Under the AssurMiFID code of conduct, we are obliged to set out a written policy for managing conflicts of interest. Below you can find out how we meet this obligation.

Legal framework

The AssurMiFID code of conduct has been in force since 30 April 2014. It is based on the Law of 30 July 2013 on increasing the protection of recipients of financial products and services and increasing the powers of the FSMA, including additional provisions, as well as on the Royal Decree of 21 February 2014 on the rules for the application to the insurance sector of Articles 27 to 28bis of the Law of 2 August 2002 regarding supervision of the financial sector and financial services and the Royal Decree of 21 February 2014 regarding the legally enforced code of conduct and rules on the management of conflicts of interest in the insurance sector.

In accordance with this code of conduct, we are obliged to set out a written policy for managing conflicts of interest when providing insurance broking services.

The legal rules on conflicts of interest are supplementary to the general MiFID framework act. We respect this framework act by acting loyally, fairly and professionally in defence of our customers' interests when providing insurance broking services.

What are the conflicts of interest?

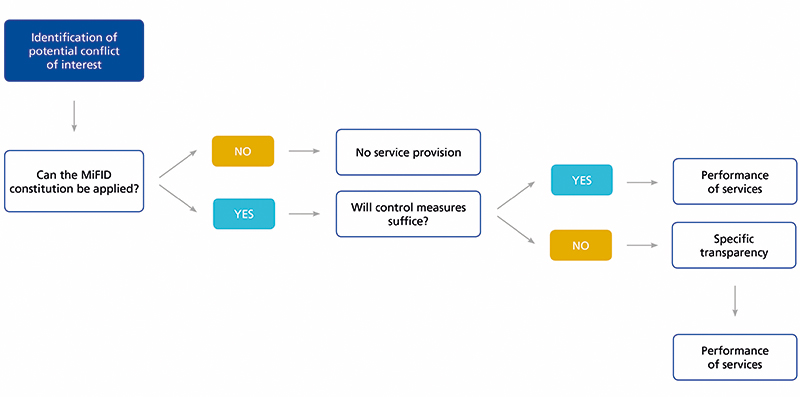

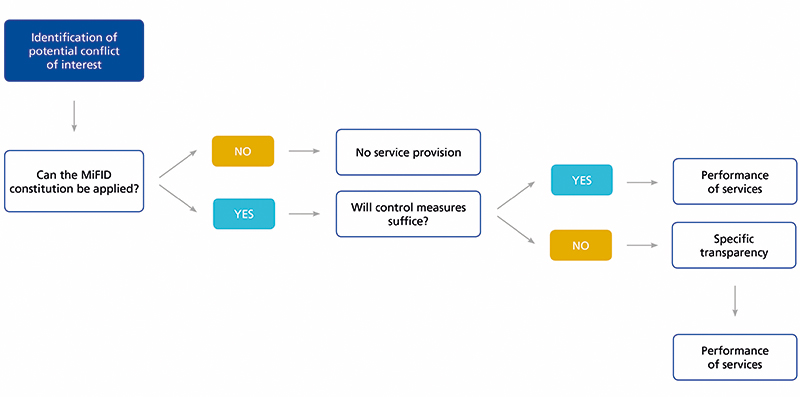

When drawing up our conflict of interest policy, we started by identifying potential conflicts of interest within our company.

Conflicts of interest can arise between (1) our company and its associates and a customer or (2) between several customers. The conflict of interest policy takes account of the specific characteristics of our company and its potential group structure.

When assessing the potential conflicts of interest, we identified situations in which there is a substantial risk of damage to the customer's interests. These include:

- situations where profits are made or losses are sustained at the expense of the customer;

- situations where our company has a differing interest with respect to the result of the service or transaction;

- situations where there is a financial incentive to prioritise other customers;

- situations where the business activity exercised is the same as that of the customer;

- situations where our company receives compensation from a person other than the customer for the insurance broking services provided;

- situations where our company holds shares of at least 10% in terms of voting rights or capital in the insurance company/companies;

- situations where the insurance company/companies hold(s) shares of at least 10% in terms of voting rights or capital in our company.

What measures are we taking?

We are taking a large number of measures to ensure that the customer's interests come first.

These include:

- an internal instruction notice;

- an adapted remuneration policy;

- a policy to ensure that our associates only provide broking services for insurance contracts where they understand the essential characteristics of those contracts and are in a position to explain them to customers;

- a policy whereby our company reserves the right to refuse to provide a service in the event of failure to find a practical solution to a specific conflict of interest, with the ultimate goal of protecting the interests of the customer;

- a code on receipt of benefits; a policy to ensure that all information our associates provide is correct, clear and not misleading.

Where necessary, we will modify and/or update the conflict of interest policy.

What is the procedure?

Specific transparency

When, in a particular situation, our measures do not provide sufficient guarantees, you will be informed by our office about the general nature and/or source of the conflict of interest in order to allow you to make a decision in consideration of the facts. You are always welcome to contact us for more information.

Remuneration

In return for our insurance broking services, we receive in principle remuneration from the insurance company, which forms part of the premium that you pay as a customer. In addition, we may receive remuneration in connection with our insurance portfolio with the insurance company in question or in return for additional tasks that we perform. Please feel free to contact us for more information.

We also receive remuneration for our insurance broking services from you as a customer.

Communication

Provision of information and communication between us and you will take place in the language you have selected or, failing that, in the language you use when communicating with our company. You can choose between Dutch, French and English.

Complaints

Our company is included in the register of insurance intermediaries held by the FSMA, Rue du Congrès/Congresstraat 12-14, 1000 Brussels, and can be viewed at www.fsma.be. If you have any questions or problems, you can start by contacting our office. We are always available by telephone, e-mail or fax.

Complaints can also be submitted to the Insurance Ombudsman, Square de Meeûs/de Meeûssquare 35, 1000 Brussels – tel.: 02 547 58 71 – fax: 02 547 59 75 – info@ombudsman-insurance.be – www.ombudsman-insurance.be.

More information?

If you would like more information about our conflict of interest policy or about what AssurMiFID means for you in practice, do not hesitate to contact us.

* Law of 30 July 2013 on increasing the protection of recipients of financial products and services and increasing the powers of the FSMA, including additional provisions as well as the Royal Decree of 21 February 2014 on the rules for the application to the insurance sector of Articles 27 to 28bis of the Law of 2 August 2002 regarding supervision of the financial sector and financial services and the Royal Decree of 21 February 2014 regarding the legally enforced code of conduct and rules on the management of conflicts of interest in the insurance sector.