Companies

Self-employed & liberal professions

Solutions

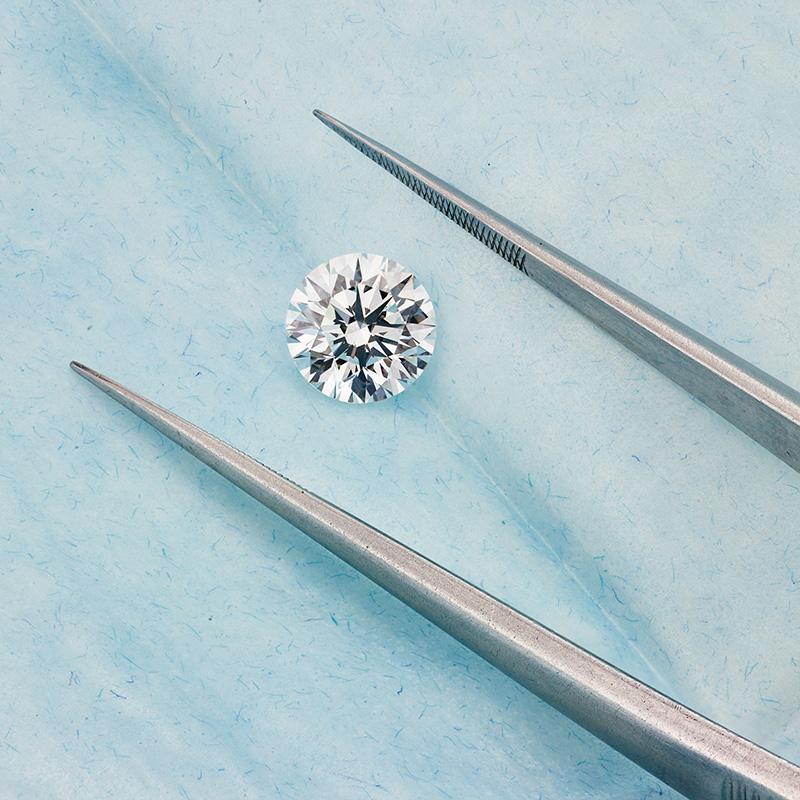

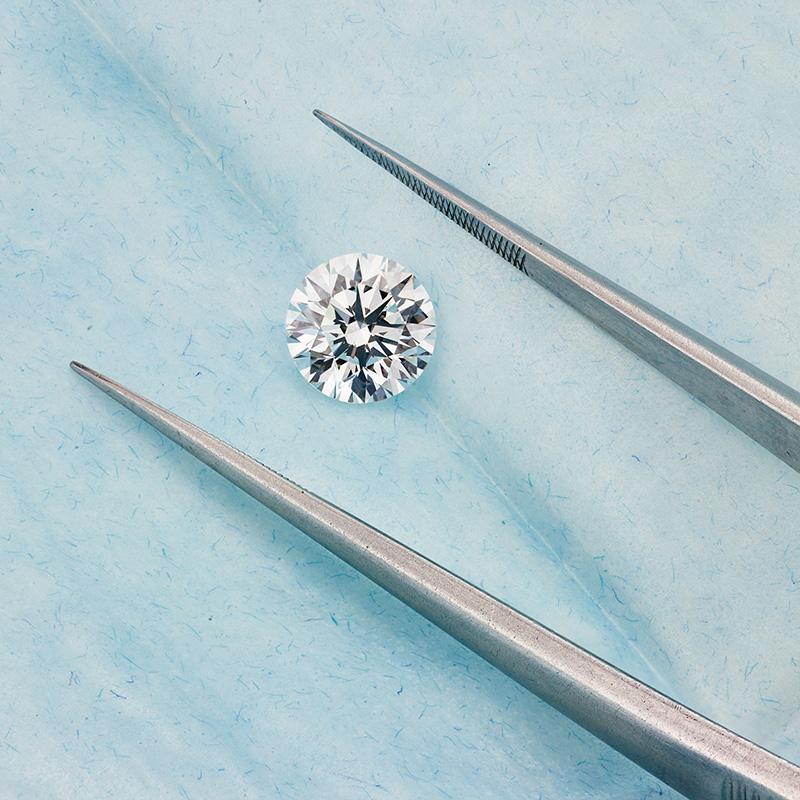

Valuables insurance

Valuables insurance covers the financial consequences of damage to or theft of valuables such as jewellery, art and antiques.

Why take out Valuables insurance?

Our experience shows that many owners of valuables have a false sense of security. On the one hand, they think that the risk of damage is relatively small for luxury products stored indoors, and on the other hand, many assume that their ordinary fire and theft insurance provides sufficient protection in the event of damage. This is not the case, however.

After all, the insured value ceiling in an ordinary fire or theft insurance policy is often far too low. For example, there is a (limited) compensation limit per damaged or stolen valuable. In the case of valuables, it is very likely that the compensation limit is insufficient to cover the actual loss. Valuables insurance gives you that certainty.

Another advantage of specific insurance for valuables is that the policy terms are always drafted on the basis of ‘all risks, except those that are specifically excluded’. In other words, such insurance covers all claims except those expressly provided for. So you know perfectly well what is covered and what is not. Moreover, in the case of damage, the burden of proof does not lie with you but with the insurer.

Why choose valuables insurance from Van Dessel?

At Van Dessel you can have your valuables, such as jewellery, art and collections, insured at a competitive rate.

In many cases, specific valuables insurance also provides worldwide cover. This is interesting for those who sometimes transport their valuables: they are thus insured all over the world and during transport.