Insights

More security in uncertain times: Why a life insurance policy is a smart choice, even for your savings

In a financial world that is constantly changing, investors are looking for stability. Traditional banking investment solutions such as stocks or mutual funds are popular, while life insurance is often overlooked, and that’s undeserved.

What are the advantages of a life insurance policy that make it a better choice than traditional banking products?

Here, we outline the five key benefits of life insurance.

Flexibility

There are two main types of life insurance used for saving or investing: Branch 21 and Branch 23.

Branch 21 offers security, with both capital and return contractually guaranteed. This option is ideal for investors who prioritise safety and low risk, even if it means a lower return.

Branch 23, on the other hand, depends on the performance of one or more investment funds. This is suited to investors who aim for higher returns and are willing to accept more risk. It is possible to switch investment funds or adjust their weight within the portfolio at least once a year free of charge.

A combination of Branch 21 and Branch 23 is also possible, allowing for a tailored solution. At Van Dessel, we believe in offering every client a solution that matches their preferences and profile — one that remains suitable throughout the policy term.

Security

Life insurance offers a high level of security, especially during uncertain times. While banks and insurers are strictly regulated, the banking crisis revealed that insurance companies are often more stable. Only a few insurers ran into trouble, highlighting their reliability.

- With Branch 21, both capital and interest are guaranteed. The interest rate is usually guaranteed per deposit or for the first eight years in the case of a lump sum premium.

- With Branch 23, there is no capital guarantee, but risk management is in place. Insurers thoroughly screen investment funds before offering them, ensuring quality for the investor.

Protection

A life insurance policy also offers protection in the event of death. Banks are required to freeze accounts until the estate is settled, which can temporarily leave the surviving partner in financial difficulty. Life insurance solves this, as the capital is typically paid out to the beneficiary within two weeks, independently of bank accounts — offering financial reassurance.

Furthermore, the capital paid out usually falls outside of the estate, meaning that creditors cannot seize it. This is a significant benefit and a source of peace of mind for investors.

Taxation

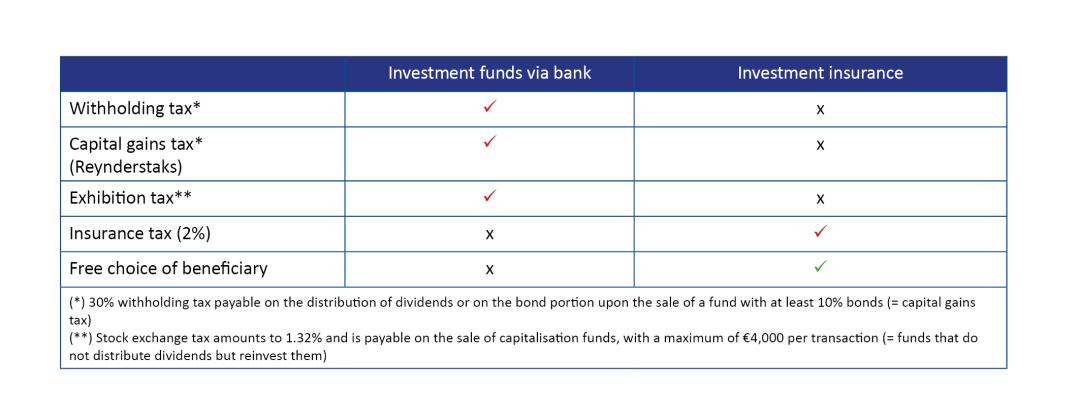

Below is a table summarising the main tax differences between life insurance and a bank investment fund.

Life insurance is ideal for investors with a long-term outlook. The longer the term, the better the return. As a result, it is less suitable for short-term investments or speculation.

A standard entry tax of 2%* applies.

- For Branch 21, there is no tax on capital gains if the payout occurs at least 8 years and 1 day after the policy start date.

- For Branch 23, there is no exit tax at all.

*Many insurers cover the 2% entry tax themselves, reducing the overall impact. We monitor this closely on your behalf.

With banking alternatives such as funds or shares, there is no entry tax, but you will pay tax on exit. This means you don’t know upfront how much tax you’ll eventually owe. The better the investment performs, the greater the advantage of life insurance over traditional banking options.

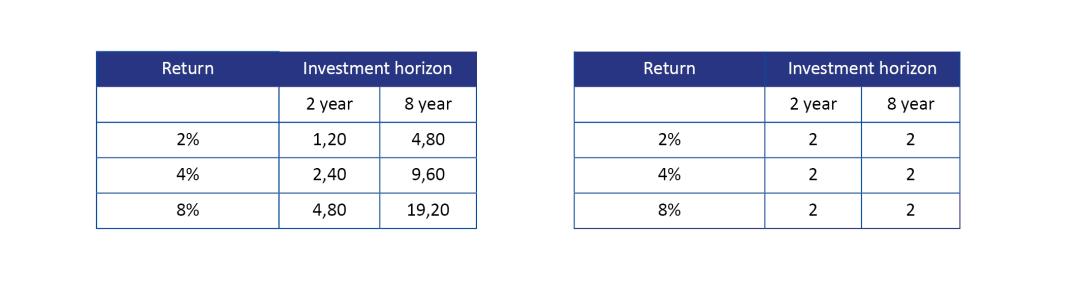

Below you will find a numerical example comparing the taxation of a bank investment portfolio with that of a life insurance policy.

As you can see, life insurance clearly comes out ahead for long-term, high-performing investments.

Beneficiary Clause

A life insurance policy involves three parties: the policyholder, the insured person, and the beneficiary. A single person may take on multiple roles in the same contract. The beneficiary clause offers several benefits:

- Freedom of choice: You decide who the beneficiary is and can change this at any time, free of charge. (For policies with tax advantages, such as pension savings, some rules apply.)

- Clarity: Avoid disputes over who is entitled to the capital.

- Responsibility: Take care of your loved ones with a death benefit. Ideal for those who feel financially responsible for a partner, children, or business partner.

- Estate planning: Life insurance is a strategic tool for transferring wealth, especially useful for unmarried individuals. It can also help avoid inheritance tax — for instance, through a generation skip where a grandchild is designated as the beneficiary.

We hope you are convinced of the many advantages of life insurance as an investment instrument. The topic is complex, which is why a specialised approach is essential. As one of the largest independent insurance brokers in Belgium, Van Dessel provides objective advice.

Interested? Contact us for a personalised savings or investment plan tailored to your needs and goals. Email us at leven@vandessel.be or call 03 482 15 30.

Delen